22 December 2023 by Georgie Tugwell

rePLANET Supports Orgnanisation’s on TNFD Adoption Journeys

Before diving into the TNFD in more detail it is important to highlight that rePLANET offers support to those organisations seeking to identify and action nature-related opportunities. rePLANET can provide expertise on addressing opportunities that fall under the ‘Ecosystem Protection, Restoration and Regeneration’, ‘Resource Efficiency’ and ‘Sustainable Use of Natural Resources’ categories that are explored later in this blog. As a company we:

Actioning nature-related opportunities with us will improve TNFD disclosed corporate performance, and this can in turn increase organisational ‘Reputational Capital’.

What is the Purpose of the TNFD?

Global biodiversity loss is accelerating at an alarming rate; transitioning to a ‘nature-positive’ economy has never been more urgently required. Regulators, investors and consumers have realised this and are beginning to demand that businesses are more transparent and accountable for their nature impacts. Mounting global concern for biodiversity loss and the 2022 Kunming-Montreal Global Biodiversity Framework prompted the development of the final Taskforce for Nature-related Financial Disclosures (TNFD) version, September 2023. The TNFD is a risk management and disclosure framework designed to promote the integration of nature into the decision-making and strategy of organisations and financial institutions. At present, TNFD reporting is not mandated by laws or regulations, however, voluntary market adoption of the framework is being tracked annually. Recommendations may be incorporated into UK policy and legislative architecture and mandatory reporting could be introduced for certain entities. Here, the TNFD structure and functions for business will be explored.

A Consistent and Complementary Design for Integrated Reporting

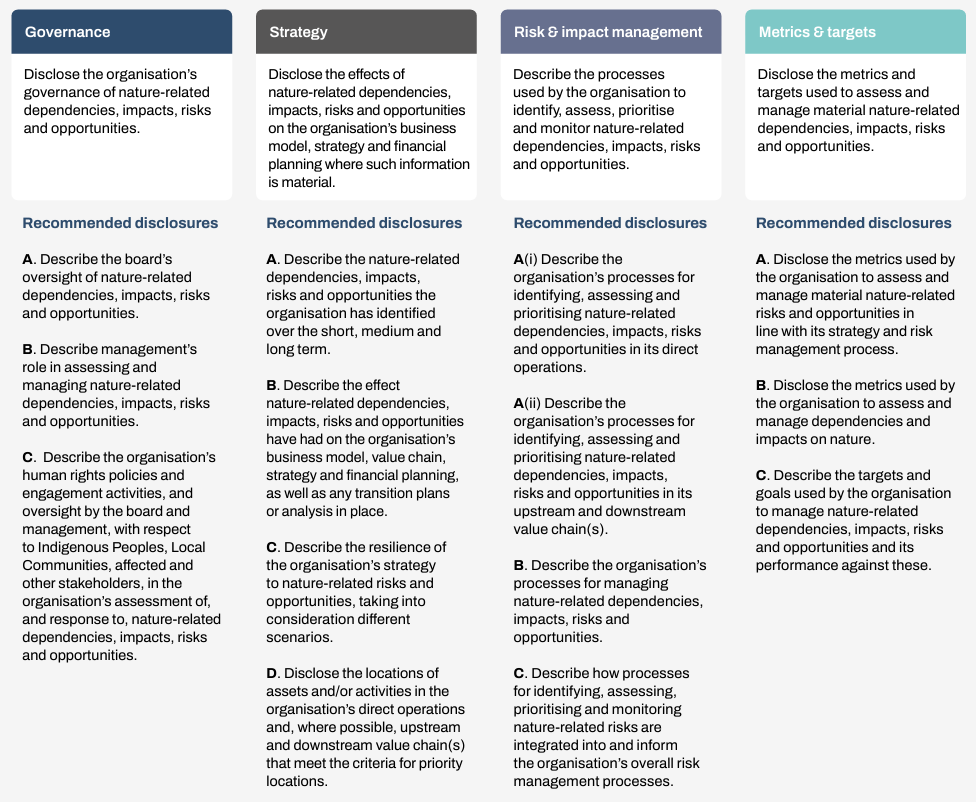

TNFD Recommendations are consistent with those of the TCFD, ISSB and GRI global sustainability standards. The TNFD is intentionally interoperable and complementary with other frameworks (e.g. TCFD, ISSB, GRI) to facilitate adoption and encourage integrated climate and nature reporting. Both the TNFD and TCFD are built around four key pillars: (1) Governance, (2) Strategy, (3) Risk & Impact Management and (4) Metrics & Targets (Figure 1). The 11 TCFD-recommended disclosures have been adapted and integrated into the TNFD alongside three completely new disclosures that focus on stakeholder rights and engagement (Governance – C), priority locations (Strategy – D), and value chain risks and impact management (Risk & Impact Management – A(ii)), respectively (Figure 1).

Figure 1: The Four Pillars of the TNFD and Recommended Disclosures (TNFD, 2023).

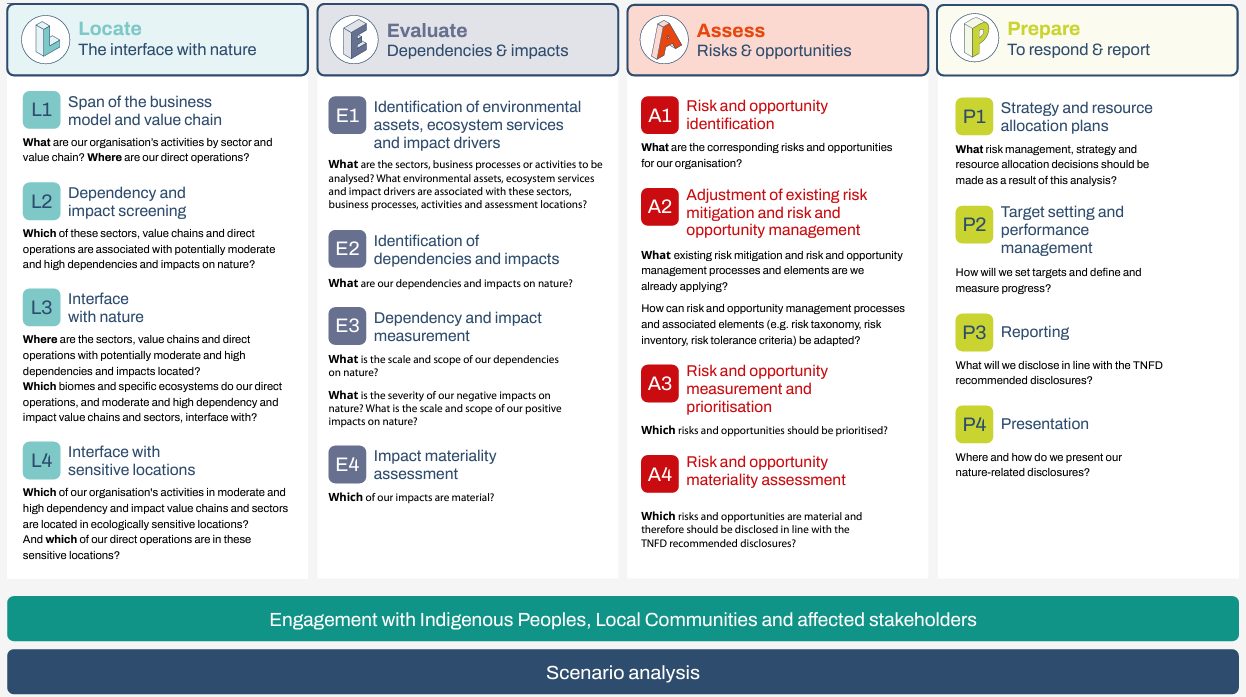

Additional to the TNFD is the LEAP Approach, this guides voluntary adoption of the TNFD-recommended disclosures, detailing how to locate interfaces with nature, evaluate nature dependencies and impacts, assess nature-related risks and opportunities and prepare to respond to these (Figure 2). LEAP is an integrated step-by-step assessment process that guides businesses through identification, assessment, management and reporting on nature-related issues. Corporates applying the approach can look to new draft versions of TNFD sector specific guidance, these explain LEAP in the context of a given sector (e.g. aquaculture) and provide sector disclosure metrics that should be used. Further guidance on integrated reporting is offered by the illustrative examples of combined TCFD and TNFD reporting. This is useful as TNFD-aligned disclosures can be integrated with TCFD-disclosures and these should be published alongside financial statements as part of the same reporting package.

Figure 2: The Locate, Evaluate, Assess & Prepare (LEAP) Approach. Each step of the approach entails four sub-components e.g. L1-L4 that must be considered for all TNFD disclosures (TNFD, 2023).

What’s New? Three Recommended Disclosures Unique to the TNFD

The TNFD recommends incorporating three additional disclosures (to those in the TCFD) into reports on nature-related issues:

1 – Human rights policies, engagement activities, oversight by the board and management with respect to indigenous peoples, local communities affected, and other stakeholders must be described in an organisation’s assessment of and response to nature-related dependencies, impacts, risks and opportunities. This new ‘Governance’ recommended disclosure details numerous points that should be described in reports such as: how human rights due diligence processes are embedded within an organisation, the processes adopted to monitor, manage and remediate any adverse human rights impacts caused by the organisation and the organisations key governance on nature-related advocacy and lobbying and the approach to engagement with public authorities on nature-related initiatives, policy and regulation. A separate document released by the TNFD guides on how to best engage with indigenous peoples, local communities and affected stakeholders.

2 – Reporting on asset and activity locations in the organisation’s direct operations and, where possible, in the upstream and downstream value chains that meet the criteria for priority locations forms another new disclosure. Priority locations are described by the TNFD as either material locations or sensitive locations. A material location is where material nature-related dependencies, impacts, risks and opportunities are identified for a given organisation and a sensitive location is where business assets and activities interface with nature in areas important for biodiversity, of high ecosystem integrity, of physical water risks and of importance for ecosystem service provision. To report on this, spatial mapping of organisational assets and activities is critical, as is describing how priority locations are defined, identified, geographically specified and aggregated. Importantly, intentions to improve or expand location assessment activities must be provided. TNFD locate phase analysis and assessment guidance and tools can be explored here. The Integrated Biodiversity Assessment tool (IBAT) enables sensitive locations (component L4 of the ‘Locate’ phase of LEAP framework) to be identified using a biodiversity map; this offers a scientifically robust starting point for assessing organisational operations location sensitivity based on biodiversity importance (one of five TNFD criteria for sensitive locations).

3 – The third new recommendation falls under ‘Risk and Impact Management’ and requires describing processes for identifying, assessing and prioritising nature-related dependencies, impacts, risks and opportunities in business upstream and downstream value chains. Disclosures should detail on points such as how the value chain is defined, its scope, the areas chosen for assessment, the assessment methods, timescales, ecological thresholds and strategies to improve data quality, traceability and location specificity over time.

What Exactly Are the TNFD Nature-related Risk Categories That the TNFD Refers to?

Nature-related risks arise from organisation dependencies and impacts on nature. Throughout the TNFD there is talk of identifying, assessing and managing an organisations nature-related risks, so what exactly are they?

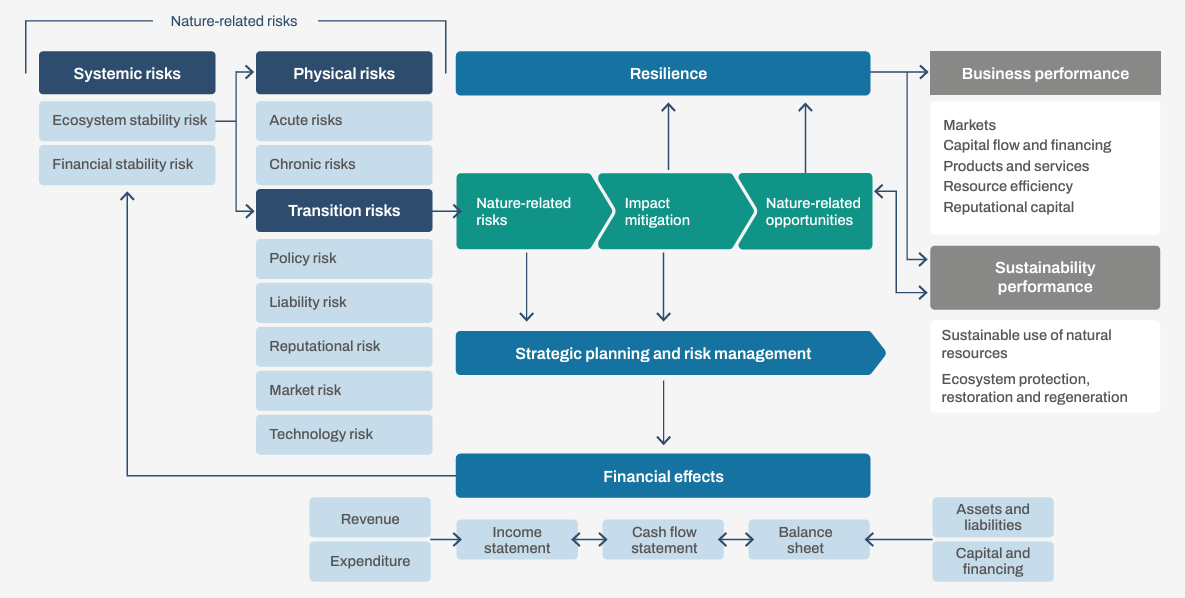

Each nature-related risk has financial impacts on an organisation, risks can change: revenue, expenses and capital expenditure, access to and cost of capital e.g. by effecting insurance premiums and the carrying amount of assets and liabilities on the balance sheet (Figure 3). On the other hand, nature-related opportunities can positively impact credit, operational, market, liquidity, liability, reputational and strategic risk (Figure 3).

Figure 3: Nature-related Risk and Opportunity Financial Effects (TNFD, 2023).

Nature-related opportunities

Activities that generate positive outcomes for organisations and nature through positive impacts or mitigation of negative impacts on nature are regarded as nature-related opportunities. The TNFD has two categories of opportunity, one related to business performance and the other to sustainability performance (Figure 4).

These opportunities arise when organisations avoid, reduce, mitigate or manage nature-related risks, these may be connected to the loss of nature and associated ecosystem services that the organisation and society depend on. Opportunities also involve strategic transformation of business models, products, services, markets and investments that actively work to halt or reverse nature loss.

Figure 4: Nature-related Opportunities Categories (TNFD, 2023).

Takeaways

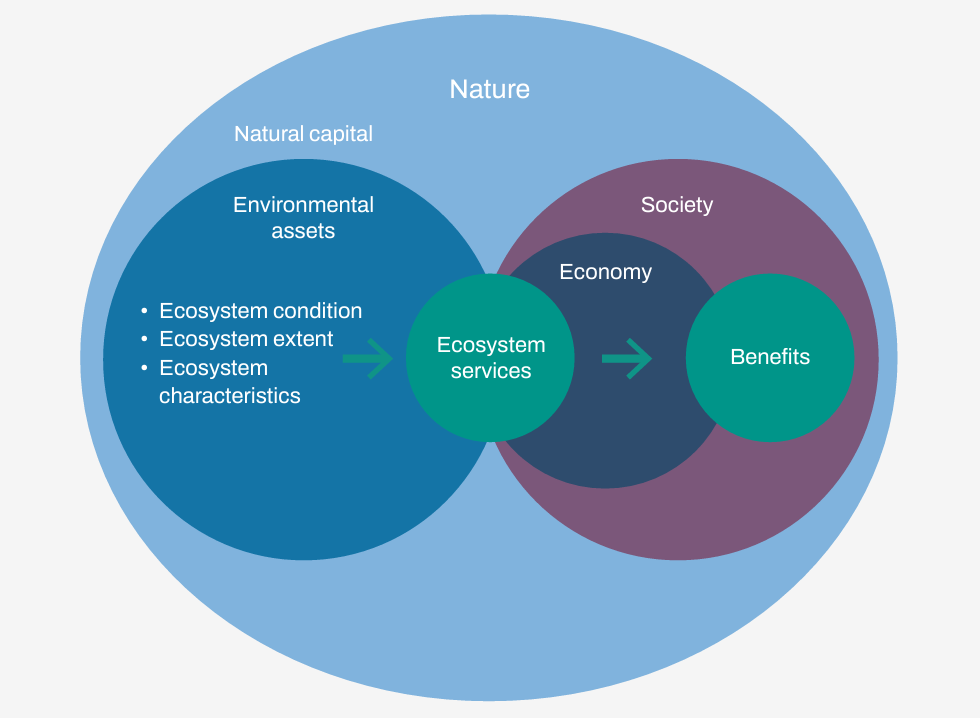

Nature, society and the economy are intrinsically linked; both society and the economy depend on and benefit from environmental assets provided by nature as these offer numerous ecosystem services (Figure 5). Declines in nature compromise societal security, increase risks to businesses and investors and impair our ability to mitigate and adapt to climate change. Therefore, mitigating nature-risks and ensuring biodiversity protection and uplift is imperative for the prosperity of current and future generations.

Adoption of the TNFD is a step in the right direction, the initiative encourages and facilitates a shift towards corporate nature-related assessment and disclosure by encouraging investment toward nature-positive outcomes. Already, over 70% of organisations from 36 countries and 11 sectors have committed to disclosing in accordance with the TNFD recommendations by their financial year 2025 or earlier.

Early adoption of the TNFD framework is encouraged, companies and financial institutions that register their intention to start adopting the recommended disclosures in the financial year 2025 or earlier will be announced at the World Economic Forum in Davos, January 2024.

Figure 5: Illustration of how nature, society and the economy are intrinsically linked (TNFD, 2023).